Earlier this week, the International Sustainability Standards Board (ISSB) released its inaugural set of sustainability standards: IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures. Referred to as IFRS SI and IFRS S2, the release of these standards represents a significant milestone in capital markets’ efforts to streamline sustainability-related disclosures into a common language.

The new sustainability standards, which go into effect on January 1st, 2024, will allow companies to disclose critical ESG data to investors using globally accepted language. However, it is important to note that disclosure is not mandatory. The authority to mandate disclosure still falls to local jurisdictions, such as the European Union’s Sustainability Reporting Directive.

IFRS S1 and S2 are designed to be used together, but the two standards cover different areas of disclosure. IFRS S1 asks companies to disclose sustainability-related risks and opportunities that, within reasonable expectations, could impact cash flow, access to finance, or cost of capital over the short, medium, or long term. More specifically, S1 prescribes how an organization should prepare and report its sustainability-related financial disclosures, including the content and presentation. ISSB’s supporting guidance includes examples of what topics might be covered, such as workforce health & safety and biodiversity management.

IFRS S2 asks companies to disclose climate-related risks and opportunities that, within reasonable expectations, could impact cash flow, access to finance, or cost of capital over the short, medium, or long term. This includes physical and transition climate-related risks, such as the impacts of extreme weather events and increased tax on carbon usage. S2 is highly reflective of the Task Force on Climate-Related Financial Disclosures’s (TCFD) recommendations.

Both standards require companies to provide disclosures on the following elements for their respective areas of focus:

- governance processes, controls, and procedures

- strategies for managing risks and opportunities

- processes for identifying, assessing, and monitoring risks and opportunities

- performance on risks and opportunities, including any targets

Standardizing Sustainability Disclosures

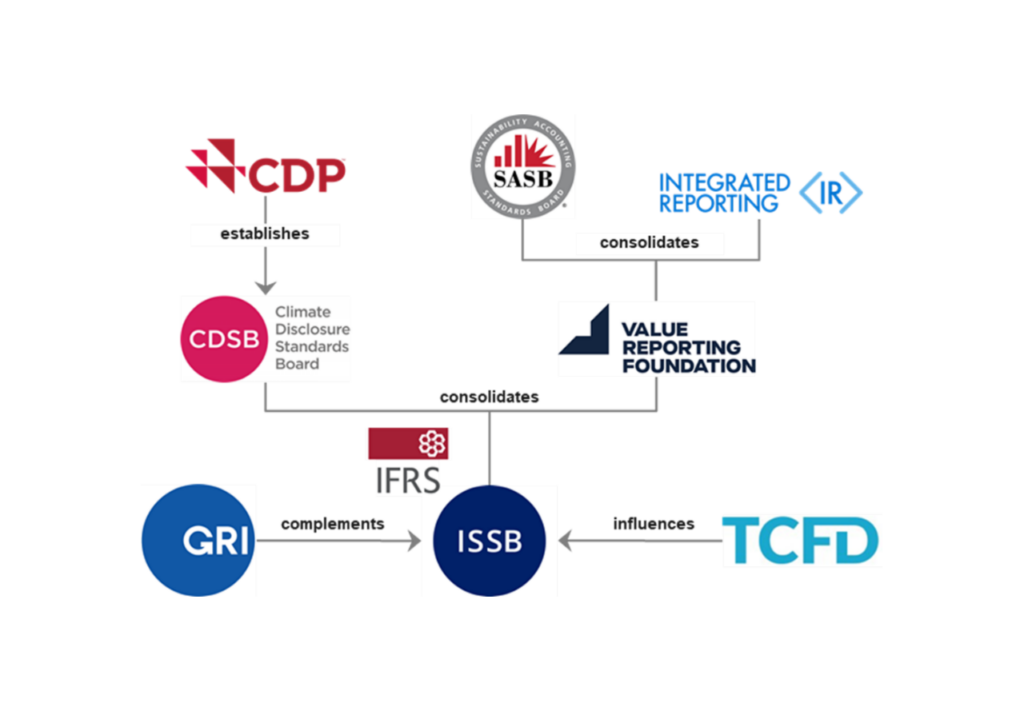

ISSB, which officially launched in 2021 at the COP26 conference, is managed by the International Financial Reporting Standards (IFRS) Foundation. IFRS also manages SASB, a popular set of standards based on material topics for 77 industries. In recent years, as investor demand for ESG data has increased, several entities have launched efforts to standardize sustainability disclosures. In addition to SASB, companies use many different voluntary frameworks, such as the TCFD, the Climate Disclosure Standards Board (CDSB), and the Global Reporting Initiative (GRI). This makes it more challenging for investors and other stakeholders to access comparable data. With IFRS S1 and IFRS S2, ISSB aims to provide a new global baseline — ISSB Chair Emmanuel Faber explained that their approach was to consolidate these voluntary initiatives. The visual below from Kirkland & Ellis demonstrates this consolidation.

Standardizing disclosures allows portfolio companies to communicate more effectively with their investors and provide consistent and comparable data. Investors can use this information to make more data-driven investment decisions during due diligence, as well as better identify areas of risk and opportunities for value creation during the ownership period, and improve exit valuation. Monitoring is already a complex process, and understandably, GPs may be hesitant to incorporate another set of ESG standards, but this is the time to start building capacity around data collection and disclosure. Regulators around the world are also increasingly requiring climate and sustainability-related disclosures to complement financial statements.

Preparing for the New ISSB Sustainability Standards

In preparation for potential future state mandatory reporting, investors should work with their portfolio companies to identify gaps in their data collection and reporting processes. For example, if a company has never collected greenhouse gas (GHG) emissions, it is advisable to begin collecting this data. It is not uncommon for companies to require multiple reporting cycles to optimize their data collection processes and, in turn, use this data for business transformation. Requirements around disclosures are also likely to evolve as the field becomes more advanced.

Here are three actions that investors can take to prepare their portfolio companies for the new ISSB standards:

- Start requesting environmental metrics–such as net zero targets, renewable energy usage, and GHG emissions–from portfolio companies now so they are prepared to provide this data in the future.

- For portfolio companies in carbon-intensive industries, consider how the transition to a lower carbon economy may impact their business model and license to operate.

- Gather insights from ESG data to identify areas of improvement and outline action plans to address sustainability and climate-related risks and opportunities.

With new regulations on the horizon, taking action now is important for investors and companies to be ready to report. Novata has the resources and expertise to help investors collect, analyze, and report on ESG data. Learn more about how Novata can help.