Five Regulations Shaping ESG Reporting for US Investors

There is a rising focus on ESG regulations in the US market, characterized by increasing investor pressures and a growing understanding of

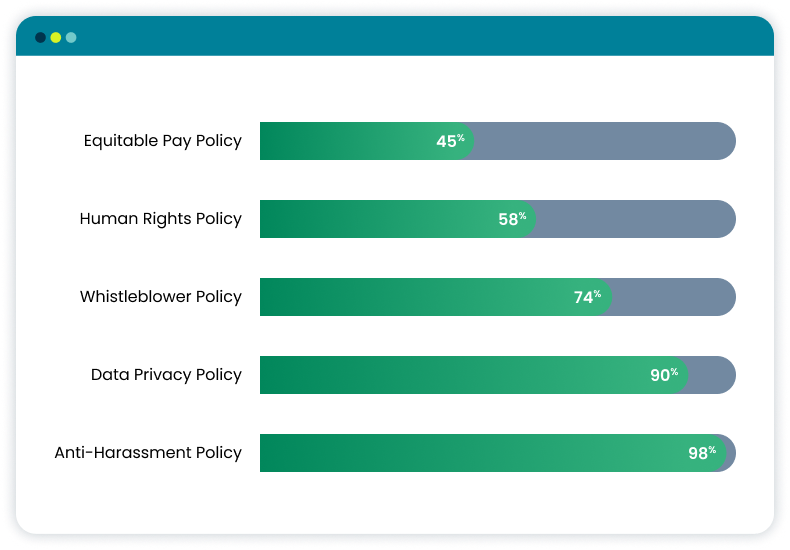

Analyzing ESG data is key to understanding ESG performance. Novata’s in-platform analytics and benchmarks, built on data from thousands of contributing companies, provide you with tools to contextualize the metrics that matter to your firm — and leverage those insights to set new standards for performance.

Data used in Novata Benchmarks is actual reported data from Novata contributors, de-identified and aggregated, and specific to the private markets.

Novata makes ESG easy and practical for private markets.

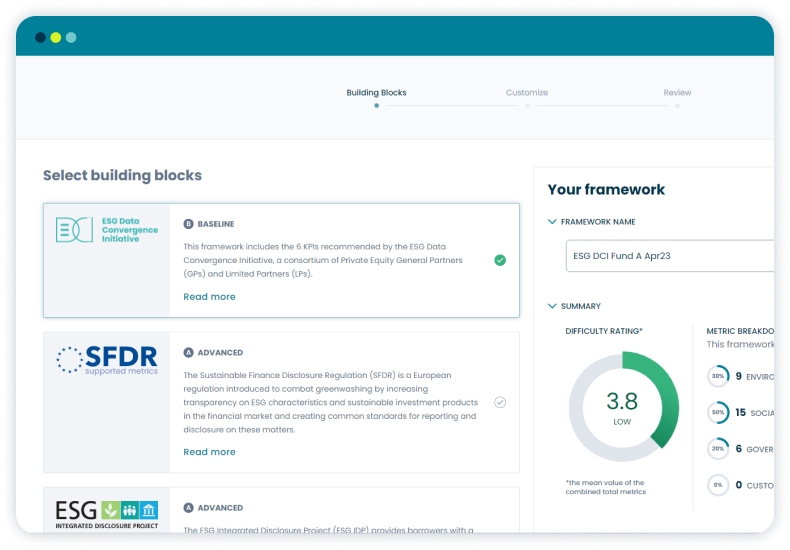

Novata makes ESG data collection simple, providing industry expertise and clear guidance for investors and portfolio companies — ensuring the data you receive is high quality and comparable.

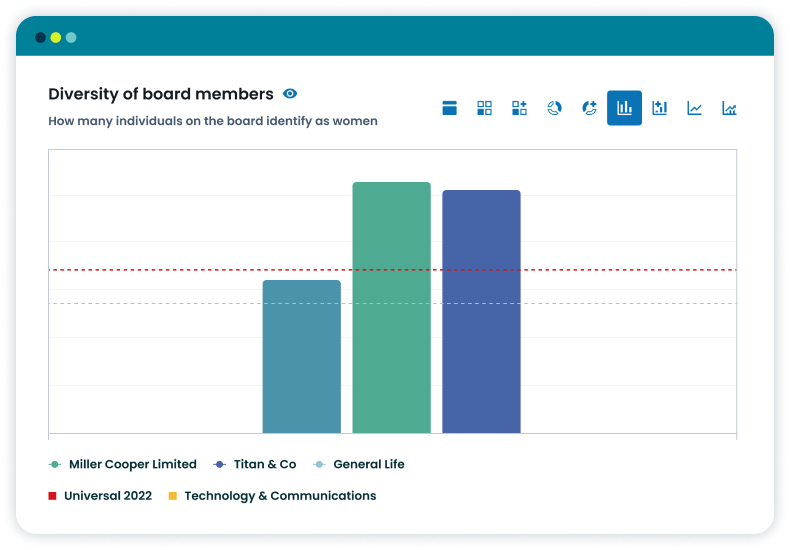

See how your portfolio companies perform against similar companies. Novata Benchmarks are aggregated from the thousands of companies on the platform, enabling you to compare ESG data to (de-identified) industry peers.

Novata’s intuitive data analytics and data visualization tools make it easy to understand your data and identify actionable insights to improve portfolio company performance.

There is a rising focus on ESG regulations in the US market, characterized by increasing investor pressures and a growing understanding of

Navigating environmental, social and governance (ESG) considerations can be challenging for investors. Over the years, the need to incorporate these considerations into

As environmental, social, and governance (ESG) obligations and demand for transparency have grown over recent years, so has the uptick in the