- Products

- Products

- FEATURES

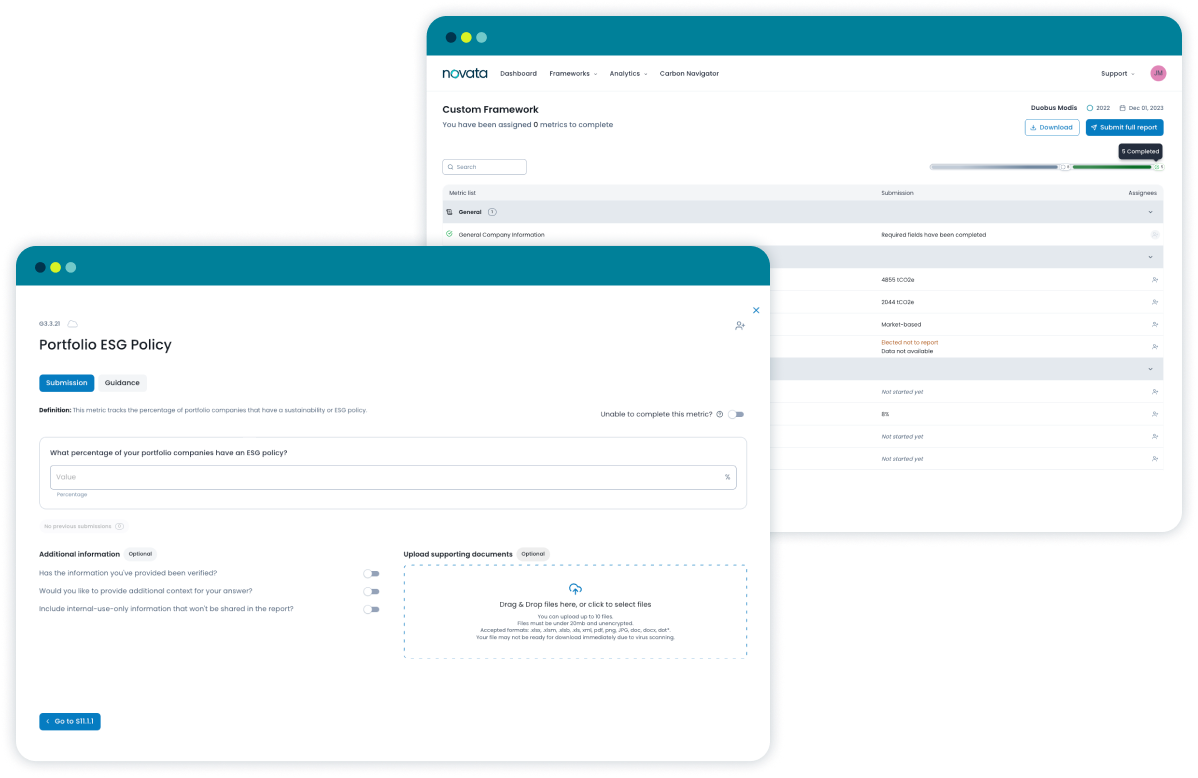

- Data ManagementTools to choose, collect, and manage ESG metrics

- Analytics & ReportingAnalytics and dashboards to share data and insights with stakeholders

- BenchmarkingPerformance comparisons against peers or industry

- Data StrategyStandards and analytics to integrate ESG across the investment lifecycle

- Regulatory ServicesCreate a strategic approach for required disclosures like SFDR and CSRD

- Sustainability ReportingTranslate your data into a compelling narrative for a variety of stakeholders

- Carbon ManagementMeasure and report emissions, and develop strategies to manage carbon

- Onboarding & SupportCustomer success, onboarding, and guidance to enhance the user experience

- Solutions

- For Investors

- For Companies

-

Maximize your investment in ESG with Novata advisory services.

Learn More →

- Resources

- Learn

-

Search our collection of resources covering a variety of ESG themes.

SEARCH OUR RESOURCE LIBRARY →

- About

- People

-

Our mission is to empower private markets to achieve a more sustainable and inclusive form of capitalism.

Learn More →

- FOR INVESTORS

- FOR COMPANIES

-

Novata's platform, services, and flexible features cover you at every stage of your ESG journey.

Learn More →

SUGGESTED SEARCHES