In the dynamic landscape of consumer packaged goods (CPG), The Craftory stands out as a beacon of purpose-driven investment. Rooted in the ethos of “cause capital,” The Craftory is a $550 million global investment firm dedicated to amplifying impact-focused CPG brands. As a certified B Corporation, the firm not only seeks financial returns but also strives to make a positive difference in sustainability and social well-being. Recognizing that “value” goes beyond just financial metrics, it uses a triple bottom line approach, where People, Planet, and Profit go hand-in-hand when investing in new brands, supporting the portfolio, and managing The Craftory as a firm itself.

When The Craftory invests in a company, the team offers tailored and robust operational support through challenges and opportunities, including around ESG and purpose. By investing in a relatively small number of companies at a time (around 15), the firm is able to nurture these investees, provide valuable support, and track progress on the material metrics crucial to the firm’s ability to support ESG-related initiatives.

Challenges in ESG Data Collection

As a trailblazer in cause capital, The Craftory has long recognized the importance of robust ESG data in both evaluating and managing investments. However, manual data collection methods, reliant on cumbersome spreadsheets and email exchanges, proved to be inefficient and time-consuming. Laura Tran, a Partner at The Craftory tasked with spearheading ESG initiatives both internally and in support of the portfolio, found herself grappling with the arduous task of summarizing and standardizing ESG information from multiple portfolio companies. The lack of a centralized platform for data collection made it difficult to effectively assess and monitor ESG performance across its investments.

“For us, it was very obvious that we needed not only an automated solution to have one platform where all companies could gather the information in a standardized way, but also the ability to pick directly from a library of questions and KPIs that would make sense in the investment world overall,” Laura said.

Finding a Data Solution

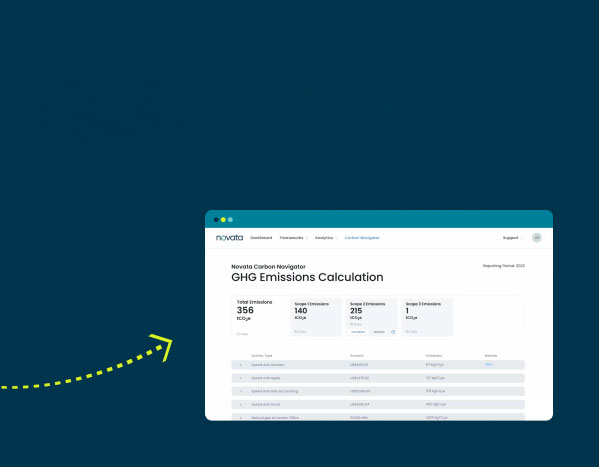

Novata emerged as a game-changer for The Craftory, offering a centralized platform to collect and manage ESG data. The platform’s capabilities helped reduce manual efforts and reliance on spreadsheets and email exchanges by making it easy for portfolio companies to respond to data requests and report on ESG performance. Novata’s customer success team also provided valuable support, helping her sort through the different frameworks, providing guidance on best practices, and confirming commonly asked questions and metrics that lead to strong benchmarks for comparison purposes.

“Something that was missing in our former methodology was whenever a company had a gap in data, we didn’t have a library of data or precise definitions on-hand to show as a reference point or benchmark,” she said. “I appreciate having the Novata team behind me to successfully execute the data collection process.”

Looking Ahead

Having successfully completed the inaugural year of data collection with Novata, The Craftory looks forward to leveraging the platform’s capabilities in the coming years. Laura anticipates meaningful insights from year-over-year comparisons and acknowledges the platform’s use in alleviating the burden on portfolio companies. “If a question was asked last year and the answer didn’t change, that data is already autofilled in the platform for them to easily confirm.”

The Craftory leverages the ESG data collected in Novata in its annual, public-facing impact report, using the data as a benchmark for its progress, as well as a standard for the industry. The Craftory aims for its report to showcase that supporting brands that help the “people, planet, and society” can also be financially savvy investments. Purpose and profit do not need to be mutually exclusive. In an era where stakeholders increasingly prioritize sustainability and impact, The Craftory’s commitment to transparency sets a precedent for the industry.

“We see mega funds adopting a similar investment thesis to us, and it’s a good sign,” Laura noted. “It shows that there is a growing interest from LPs to have more investments in ESG and impact.” This rise in interest signals a paradigm shift towards more conscientious investment practices that consider more than just financials.

The Craftory’s partnership with Novata exemplifies the transformative power of technology in advancing ESG practices within the investment landscape. By overcoming the challenges of manual data collection and leveraging Novata’s platform, The Craftory has strengthened its commitment to sustainability and societal impact.