The Sustainable Finance Disclosure Regulation (SFDR) reporting season is now in full swing. The first annual Principal Adverse Impact (PAI) statement is mandatory for GPs to report on their websites by June 30, 2023, meaning underlying portfolio company data collection is currently in progress. The PAI statement discloses the negative impact of investment activity and advice on sustainability factors, such as human rights, anti-corruption matters, and employee, social, and environmental metrics.

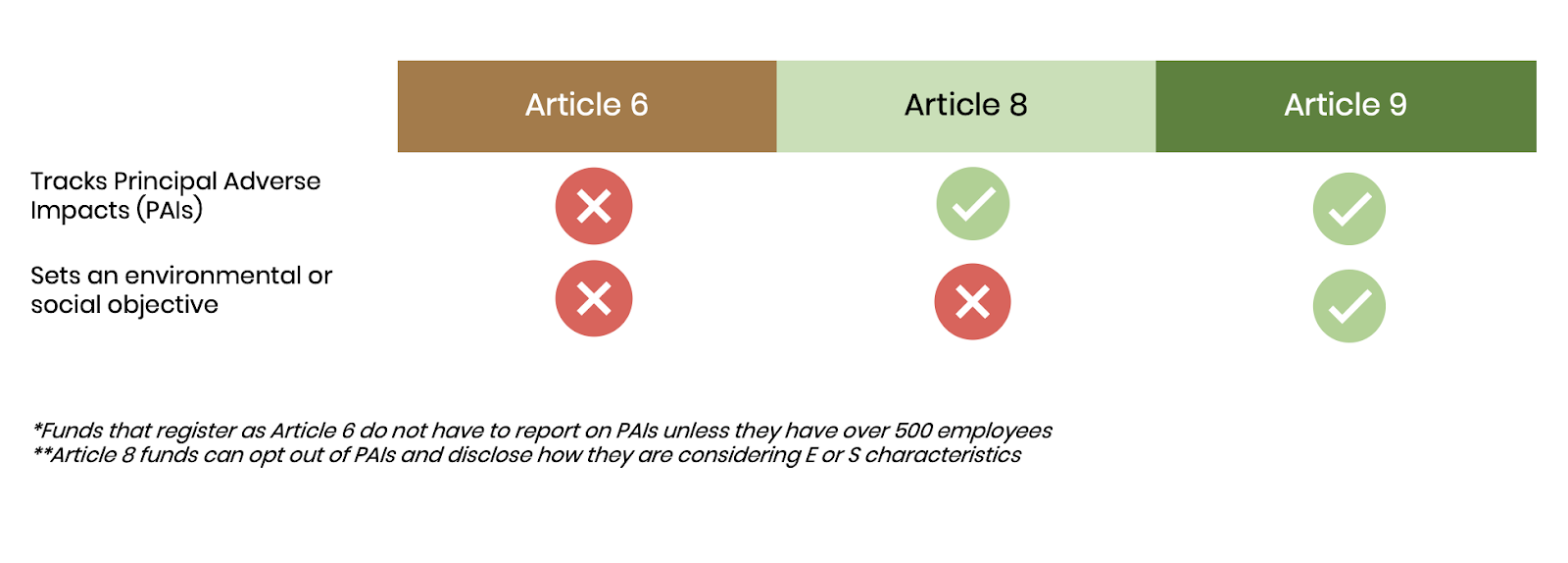

Depending on a fund’s designation (i.e., Article 6, 8, or 9), there are different SFDR data collection and PAI calculation processes. For instance, while some Article 8 firms are not reporting on the PAIs, those that are face the challenge of creating an initial baseline in the inaugural year of a landmark sustainability regulation. For firms with smaller portfolios, the data collection process is straightforward. However, firms with large portfolios may be exploring proxy or estimation methods to make data collection simple.

Although there is nuance depending on the fund thesis, typically, we see clients report on PAIs based on the following:

There are exceptions to the diagram above, but the key difference between Articles 8 and 9 is the investments needed to achieve the sustainability objective of the fund.

- Article 8: fund managers only need to consider “environmental” or “social” characteristics

- Article 9: fund managers must act on “environmental” or “social” with their investment

- Separately, Article 6 funds do not have to make investments based on sustainability considerations and are subsequently not tracking PAIs, unless their company has over 500 employees.

There are degrees of variation within each classification—however, this summarizes the differences between each. As always, fund managers should consult legal counsel based on their fund’s objective and geographical jurisdictions.

Under SFDR, firms are required to report on 16 mandatory PAIs, 14 of which are considered core PAIs. Unfortunately, since the core PAIs are fund-level calculations, firms can’t simply send them to their portfolio companies. Underlying KPIs at the portfolio company level are critical to calculating each PAI. To make the complex simple, Novata has written the underlying KPIs to make sense for the portfolio company and designed a process for an efficient roll-up at the PAI level. The table below distills this information to help make sense of PAI calculation: each PAI is paired with the underlying KPIs needed from the portfolio companies, in addition to the normalizing variables (like revenue, enterprise value, etc.) needed for complete PAI calculation.

While the PAI statement is an annual disclosure, the European Supervisory Authority (ESA) recommends that firms track the underlying data on a quarterly basis (March 30, June 30, September 30, and December 31) to account for any changes in buying or selling various assets. Averaging this quarterly data into an annual roll-up is one of a few aggregation pieces needed at the portfolio level.

Breaking Down the Principal Adverse Impacts

| PAI | UNDERLYING KPIS | OTHER VARIABLES | |

|---|---|---|---|

| 01 | Greenhouse Gas (GHG) Emissions |

|

|

| 02 | Carbon Footprint |

|

|

| 03 | GHG intensity of investee companies |

|

|

| 04 | Exposure to companies active in the fossil fuel sector |

|

|

| 05 | Share of non-renewable energy consumption and production |

| |

| 06 | Energy consumption intensity per high-impact climate sector |

|

|

| 07 | Activities negatively affecting biodiversity-sensitive areas |

|

|

| 08 | Emissions to water |

|

|

| 09 | Hazardous waste and radioactive waste ratio |

|

|

| 10 | Violations of UN Global Compact principles and Organisation for Economic Cooperation and Development (OECD) Guidelines for Multinational Enterprises |

|

|

| 11 | Lack of processes and compliance mechanisms to monitor compliance with UN Global Compact principles and OECD Guidelines for Multinational Enterprises |

|

|

| 12 | Unadjusted gender pay gap |

| |

| 13 | Board gender diversity |

| |

| 14 | Exposure to controversial weapons (anti-personnel mines, cluster munitions, chemical weapons, and biological weapons) |

|

|

Calculating PAIs with Novata

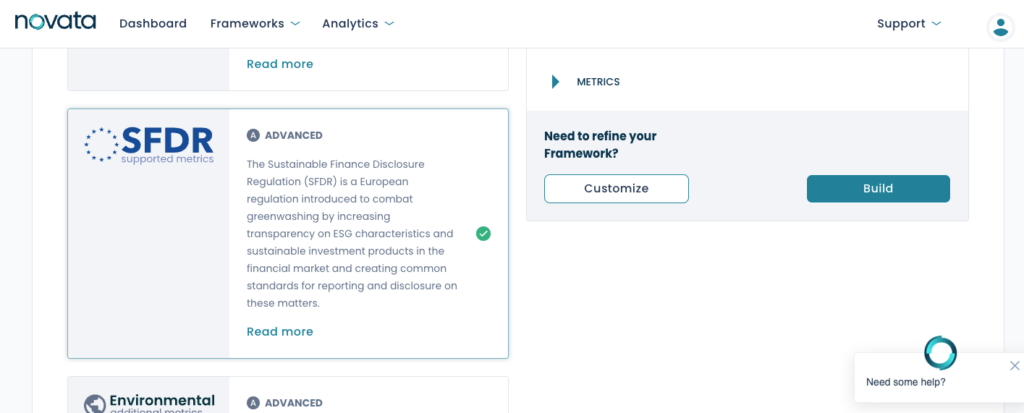

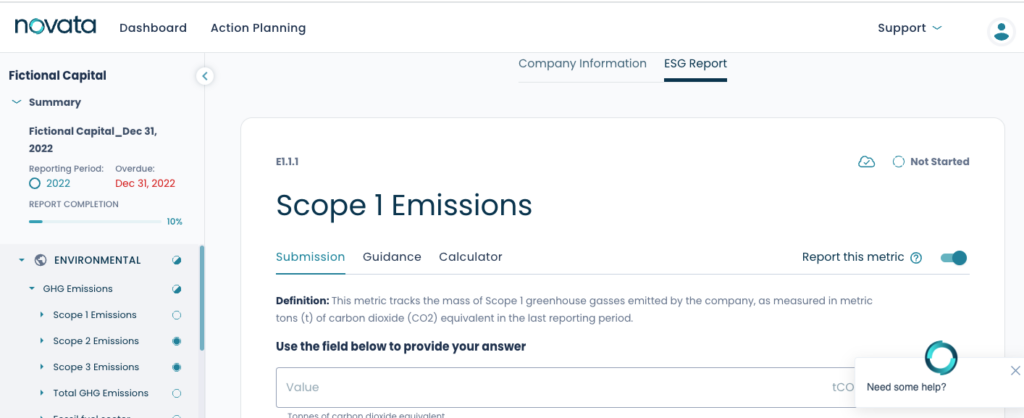

To calculate each PAI, general partners (GPs) must ask their portfolio companies to answer a number of underlying questions that will enable them to calculate the PAIs at their portfolio level. The Novata platform is aligned with the SFDR framework to help firms collect the necessary data for these calculations. In the Novata platform, GPs select the SFDR building block, which includes all of the KPIs in the middle column of the table above.

Portfolio companies receive these report requests and can easily fill out the KPIs for each PAI.

After companies fill these reports, the GP has the underlying data to calculate each PAI. The Novata team will then review each PAI with the GP and show how they were calculated using their underlying data. If GPs prefer a more hands-off approach, Novata will complete the roll-up process on behalf of the GP.

SFDR is a complex regulation, and investors must understand their obligations to meet the requirements. Novata can help simplify data collection and reporting for SFDR. To learn more about how Novata can help, reach out to speak with a specialist.